Celebrating 30 years as the nation’s most experienced developer of spine & orthopedic centers of excellence.

- 817-481-2450

- Contact Us

-

Spine Center Development

Market Assessment: Finding out what customers want

Market assessment and strategic planning. It's surprising, but few medical providers ask their referral sources if they are meeting their needs. New centers are built and launched without ever involving future users. Basically, healthcare providers skip step one—market research.

Marketing 101: Ask the customer what he or she wants. Prizm starts a development project by meeting with managed care and large employers. By involving them in the beginning, the center can be engineered from the ground up to be extremely attractive to large referral sources.

As a first step in developing a strategic business plan, Prizm always meets one-on-one with managed care contracting directors and medical directors; large employer benefit managers; work comp insurance carriers; and medical referral sources. These meetings identify the competitors in the market and how they are perceived by referral sources and opinion leaders. This competitor overview reveals:

- How competitors are currently positioned

- If there is an opportunity to develop a new center of excellence

- How this center should be customized to meet the specific needs of the market

- What contracts are available and under what reimbursement mechanism, e.g., discounted fee for service, global price packages, capitation, etc.

More importantly, this interview process involves the customer and referral source in the design stage, enabling them to lend useful insight into how the center of excellence may be customized to meet their needs.

Within a market assessment, Prizm outlines how current providers in the local area are perceived, what the desirable components of an "ideal" back treatment center are and what the interest level is with a proposed center that would include the sponsoring physicians. The feedback can influence how the spine center would be developed. The final report includes proforma revenue projections for the center of excellence and strategic recommendations that improve the likelihood of success.

Collect data that documents superior value.

|

|

|

|

|

|

|

|

|

|

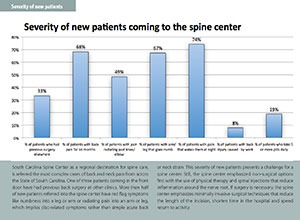

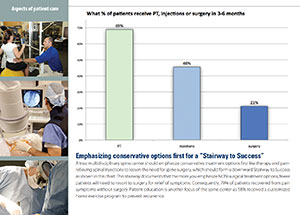

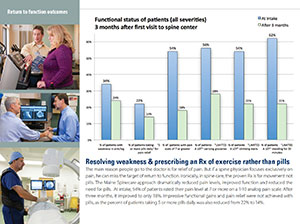

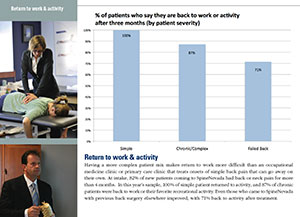

You MUST collect clinical outcome data at intake and follow-up intervals that document patient severity as well as show positive changes in patient status. That data will enable your clinic to defend itself against critics who label your clinic as expensive. Your mean patient charge may be high compared to competitors, but in many cases it will be that way because you are dealing with the train wrecks, rather than creampuff virgin backs. Additionally, these data collection tools can audit patient satisfaction after visiting the clinic.

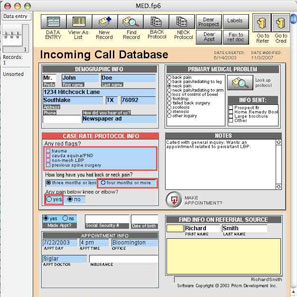

The database software used by Prizm, for example, is relational, which enables Prizm to merge charge databases from the group practice or hospital with demographic data and clinical outcome data. The result is reports that can show the mean cost to treat various ICD-9 categories in your group practice. This information can also be used for global price packaging with managed care.

Pricing Strategies

Develop global "packages" that are attractive to employers and managed care.

Most physician groups fail with managed care because they take an adversarial rather than cooperative position.

What managed care wants is documented value and predictability. A spine center can deliver better care and at a better price than other fragmented providers who provide care that goes nowhere.

By packaging fragmented services, a clinic can lend cost predictability to employers and managed care organizations. A case rate can include physician office fees, diagnostics like X-rays, MRI and CT, injection therapy, surgery, operating room charges, inpatient hospital stay, and post surgical rehabilitation at a therapy center. In the past, you billed by CPT code, but in the future, you may bill by ICD9.

Prizm has done the statistical analysis of mean cost by ICD9 of various symptom paths, and has in turn developed clinical protocols that enables a spine center to provide a predictable price for a four week episode of care. This predictability is highly attractive to payors who are frustrated with the fragmented and unpredictable nature of spine care.

In addition to successfully contracting with large entities like Blue Cross with global prices for NON-surgical aspects of spine care, Prizm has successfully contracted with managed care entities for surgical procedures. All these strategies position the spine center as an ally to managed care rather than an adversary.

Promotion Strategies

Position yourself as the expert source for information.

Your group must stand out as the expert source for information in your specialty. For example, for its centers, Prizm develops all the marketing communication tools that are necessary to achieve the strategic goals of the center of excellence, including but not limited to the following:

- Brochures

- Internet electronic brochure/web site

- Educational inserts, home remedy inserts, exercise inserts, etc.

- Print ad campaign

- Radio ad campaign

- Direct mail campaigns

Select image to view SpineNevada online |

Develop communication tools that make the prospect a more-informed customer.

You need to invest in educational consumer information tools, including home remedies and self-diagnostic aids, that position you close to the consumer. These consumer information tools can also be distributed through employer audiences to align your group with local businesses.

Develop databases that track prospect, customer and referral source information.

Relationship marketing is the buzzword of the 1990s. The intent is to track information on existing prospects, customers and sources of new business. To do so, you need database tracking systems that reveal return-on-investment, which prospects convert to customers, and which referral sources send business and how much.

|

|

Audit customer and referral source satisfaction.

Lastly, your center needs to focus in on customer satisfaction measurement, and assessing and meeting the ongoing needs of referral sources like other physicians, managed care and employers. We hope this quick formula guide is helpful in getting a framework for success for your center.

Disclaimer:

The pictures displayed in this website are images of physicians, patients and employees who have consented to have their pictures in this website. If you are viewing in Internet Explorer 8 or older you may need to update your browser.

RELATED TOPICS

Spine Center Development How to Launch a Spine Center Market Assessment Spine Center Design Space Planning Name Development Medical Advice Exercise Library Patient Education Case Rate Pricing ASCs & Specialty HospitalsHAVE A QUESTION?

Wouldn’t it be convenient if someone created a listing of spine centers of excellence across the United States that all emphasize non-surgical treatment options before surgery?

Finally, there is a place.

Centers for Artificial Disc is the only verified national listing of spine centers that specialize in artificial disc replacement surgery.

CentersForArtificialDisc.com